May 15, 2013

Attain Capital

Like

When a friend of ours headed to the World Series of Poker last summer mentioned basing his bet size on Fortune’s Formula, and we gave him a semi-blank stare – he told us to go pick up the book Fortune’s Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street by William Poundstone. So we did. And are we glad we did. Talk about breadth of subject. How about tying in information theory, mobsters, Ivan Boesky, Long Term Capital Management, Rudy Giuliani, and “beat the dealer” in blackjack?

by William Poundstone. So we did. And are we glad we did. Talk about breadth of subject. How about tying in information theory, mobsters, Ivan Boesky, Long Term Capital Management, Rudy Giuliani, and “beat the dealer” in blackjack?

William Poundstone’s book is ostensibly about the Kelly Criterion, a formula used to calculate the optimal bet size given one knows their probability of winning and the payout odds for a winning bet. An example from Wikipedia: if a gamble has a 60% chance of winning (p = 0.60, q = 0.40), but the gambler receives 1-to-1 odds on a winning bet (b = 1), then the gambler should bet 20% of the bankroll at each opportunity (f* = 0.20), in order to maximize the long-run growth rate of the bankroll.

But the real story is the historical characters laid out therein.

There is Claude Shannon – the father of information theory whom Poundstone argues was on Einstein’s level. Ed Thorp, who adapted the Kelly Criterion to card counting and playing blackjack to several successful hedge funds. There is mobster Manny Kimmel, who turned a parking lot won in a craps game into a parking lot company which eventually bought film studio Warner Brothers, which eventually became Warner Communications, and eventually merged with Time Inc. to create the Time Warner whose internet connection you might be using right now. There is the story of a young Rudy Giuliani fighting crime in New York. There is Boesky and Milken and Merton Shcoles and Fisher and Black and Merriwhether. And a great Warren Buffet fable about every person in the US flipping coins we hadn’t seen before.

Then there are the lessons gleaned. Such as why insider trading is so appealing to those utilizing the Kelly criterion (because the odds of success go way up), and how overbetting even on a positive expectancy outcome can result in ruin. There is talk about the failings of VaR and Black Scholes and Long Term Capital Management. And there is the overarching lesson of the Kelly Criterion that risking a fraction of your bankroll (investment amount) on each successive “bet” removes the risk of ruin (ignoring minimum investments or table minimums, and the like) while providing the largest possible long term growth.

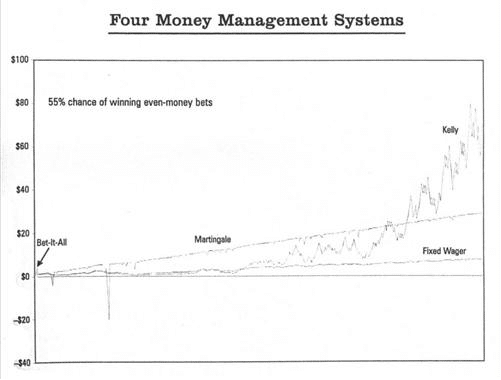

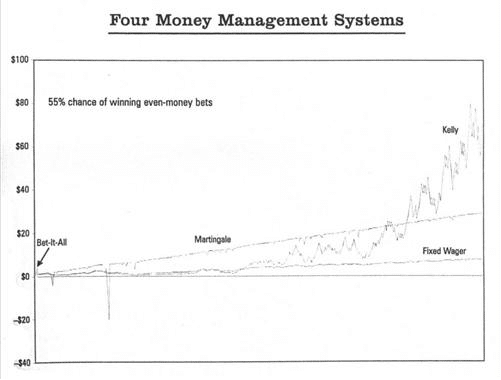

Below is the graph from the book comparing four money management systems using a simple example of even money bets with a 55% chance of winning. You can see the brief flame out of the bet it all bettor. The deceivingly smooth line of the Martingale bettor (if you lose, bet double the next time) except for the large drawdown during a losing streak, the slow and steady gains of the fixed wager – and finally the volatile but largest gainer in the Kelly method. (Excuse the quality of the image – it was pulled from somewhere on Google and likely a scan from the book, not created digitally by us.)

We couldn’t help but keep thinking back to systematic trading models in the managed futures space in reading the book, because fractional betting on the ongoing bankroll is how managed futures operate for the most part: risking a fraction of the investor’s ongoing account on each trade so as to reduce trading during a losing streak and compound winning by larger bet sizes during winning streaks. We know two things for sure. One, we’ll be adding this book to our list of market favorites, and two, we’ll be asking managers we talk to from here on out their views on the Kelly Criterion are… and docking them a few points if we get that blank stare back.

Disclaimer

The performance data displayed herein is compiled from various sources, including BarclayHedge, and reports directly from the advisors. These performance figures should not be relied on independent of the individual advisor's disclosure document, which has important information regarding the method of calculation used, whether or not the performance includes proprietary results, and other important footnotes on the advisor's track record.

The programs listed here are a sub-set of the full list of programs able to be accessed by subscribing to the database and reflect programs we currently work with and/or are more familiar with.

Benchmark index performance is for the constituents of that index only, and does not represent the entire universe of possible investments within that asset class. And further, that there can be limitations and biases to indices such as survivorship, self reporting, and instant history. Individuals cannot invest in the index itself, and actual rates of return may be significantly different and more volatile than those of the index.

Managed futures accounts can subject to substantial charges for management and advisory fees. The numbers within this website include all such fees, but it may be necessary for those accounts that are subject to these charges to make substantial trading profits in the future to avoid depletion or exhaustion of their assets.

Investors interested in investing with a managed futures program (excepting those programs which are offered exclusively to qualified eligible persons as that term is defined by CFTC regulation 4.7) will be required to receive and sign off on a disclosure document in compliance with certain CFT rules The disclosure documents contains a complete description of the principal risk factors and each fee to be charged to your account by the CTA, as well as the composite performance of accounts under the CTA's management over at least the most recent five years. Investor interested in investing in any of the programs on this website are urged to carefully read these disclosure documents, including, but not limited to the performance information, before investing in any such programs.

Those investors who are qualified eligible persons as that term is defined by CFTC regulation 4.7 and interested in investing in a program exempt from having to provide a disclosure document and considered by the regulations to be sophisticated enough to understand the risks and be able to interpret the accuracy and completeness of any performance information on their own.

RCM receives a portion of the commodity brokerage commissions you pay in connection with your futures trading and/or a portion of the interest income (if any) earned on an account's assets. The listed manager may also pay RCM a portion of the fees they receive from accounts introduced to them by RCM.

Limitations on RCM Quintile + Star Rankings

The Quintile Rankings and RCM Star Rankings shown here are provided for informational purposes only. RCM does not guarantee the accuracy, timeliness or completeness of this information. The ranking methodology is proprietary and the results have not been audited or verified by an independent third party. Some CTAs may employ trading programs or strategies that are riskier than others. CTAs may manage customer accounts differently than their model results shown or make different trades in actual customer accounts versus their own accounts. Different CTAs are subject to different market conditions and risks that can significantly impact actual results. RCM and its affiliates receive compensation from some of the rated CTAs. Investors should perform their own due diligence before investing with any CTA. This ranking information should not be the sole basis for any investment decision.

See the full terms of use and risk disclaimer here.

by William Poundstone. So we did. And are we glad we did. Talk about breadth of subject. How about tying in information theory, mobsters, Ivan Boesky, Long Term Capital Management, Rudy Giuliani, and “beat the dealer” in blackjack?

Disclaimer

The performance data displayed herein is compiled from various sources, including BarclayHedge, and reports directly from the advisors. These performance figures should not be relied on independent of the individual advisor's disclosure document, which has important information regarding the method of calculation used, whether or not the performance includes proprietary results, and other important footnotes on the advisor's track record.

The programs listed here are a sub-set of the full list of programs able to be accessed by subscribing to the database and reflect programs we currently work with and/or are more familiar with.

Benchmark index performance is for the constituents of that index only, and does not represent the entire universe of possible investments within that asset class. And further, that there can be limitations and biases to indices such as survivorship, self reporting, and instant history. Individuals cannot invest in the index itself, and actual rates of return may be significantly different and more volatile than those of the index.

Managed futures accounts can subject to substantial charges for management and advisory fees. The numbers within this website include all such fees, but it may be necessary for those accounts that are subject to these charges to make substantial trading profits in the future to avoid depletion or exhaustion of their assets.

Investors interested in investing with a managed futures program (excepting those programs which are offered exclusively to qualified eligible persons as that term is defined by CFTC regulation 4.7) will be required to receive and sign off on a disclosure document in compliance with certain CFT rules The disclosure documents contains a complete description of the principal risk factors and each fee to be charged to your account by the CTA, as well as the composite performance of accounts under the CTA's management over at least the most recent five years. Investor interested in investing in any of the programs on this website are urged to carefully read these disclosure documents, including, but not limited to the performance information, before investing in any such programs.

Those investors who are qualified eligible persons as that term is defined by CFTC regulation 4.7 and interested in investing in a program exempt from having to provide a disclosure document and considered by the regulations to be sophisticated enough to understand the risks and be able to interpret the accuracy and completeness of any performance information on their own.

RCM receives a portion of the commodity brokerage commissions you pay in connection with your futures trading and/or a portion of the interest income (if any) earned on an account's assets. The listed manager may also pay RCM a portion of the fees they receive from accounts introduced to them by RCM.

Limitations on RCM Quintile + Star Rankings

The Quintile Rankings and RCM Star Rankings shown here are provided for informational purposes only. RCM does not guarantee the accuracy, timeliness or completeness of this information. The ranking methodology is proprietary and the results have not been audited or verified by an independent third party. Some CTAs may employ trading programs or strategies that are riskier than others. CTAs may manage customer accounts differently than their model results shown or make different trades in actual customer accounts versus their own accounts. Different CTAs are subject to different market conditions and risks that can significantly impact actual results. RCM and its affiliates receive compensation from some of the rated CTAs. Investors should perform their own due diligence before investing with any CTA. This ranking information should not be the sole basis for any investment decision.

See the full terms of use and risk disclaimer here.