Where is crude going? Will the grain markets stay this low for much longer? When will stock indices take their dip? Will the U.S. Dollar rally? It’s a subliminal way of asking for a genie or a crystal ball, and the futures market equivalent of asking your neighbor how high Facebook or Amazon’s stock will go. Your guess is as good as ours.

One way to get a look at these ‘guesses’ on where future prices will be is the futures price curve, which shows the prices of different futures contract months on a curve going out in time. Now, technically, this isn’t a bet on where future prices will be, it’s what people are willing to pay today for production in those future months (if you ever wondered why futures confuse people). We call this a “price curve” in the business and its due to futures markets having fixed term contracts which expire at specific dates, and many different ‘contract months’ for each commodity futures market. For example, you can trade October 2016 Crude Oil, or March 2017 Crude Oil, or December 2020 Crude Oil – where you pay a price today for delivery of 100 barrels of Oil at a future date.

Now, intuitively, most people probably assume you would pay less today for something that will be delivered many months (or years) from now, given the time value of money, that the receiver of the money could earn interest and the whole ‘bird in the hand’ argument where a producer is likely to book guaranteed future revenue for a discount. That sort of a price curve, where the further out contracts are priced lower, is called Backwardation.

But surprisingly, that’s not the way price curves always work. Many times, the further out contract is priced higher in a curve structure referred to as “Contango”. Why would people pay more today, for product they won’t get in months or years. Well, they may think it will be in less supply a few months from now, or interest rates will be higher, or the dollar will be lower. It may cost more, but there’s still savings because they don’t have to store the commodity.

Many factors go into the collective market wisdom that sets these curves on a day to day basis, but the key is that they are dynamic, and a key component of futures markets; with strategies such as spread trading and relative value programs based on movements in the ‘curve’. It also means creating securities based on them somewhat problematic (see Natural Gas ETFs: Heads you Lose, Tails you Lose more…)

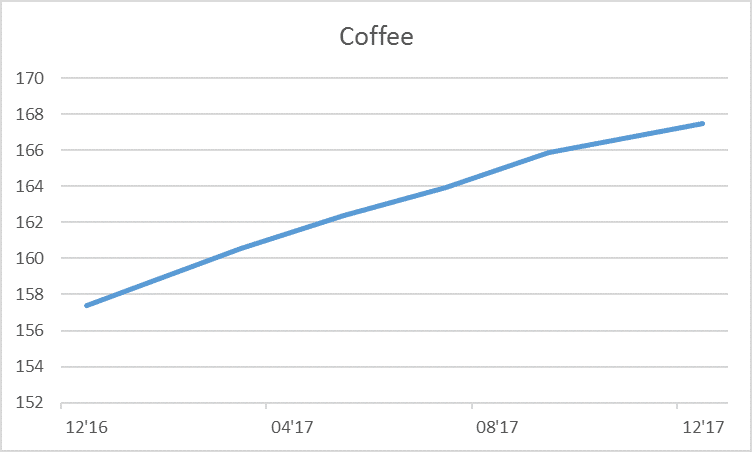

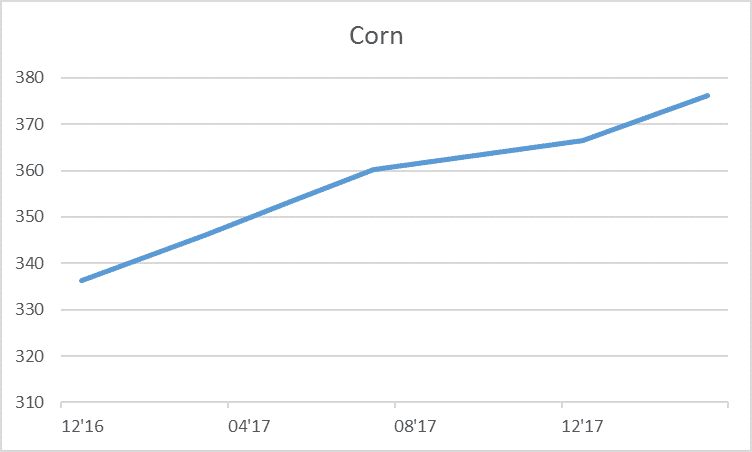

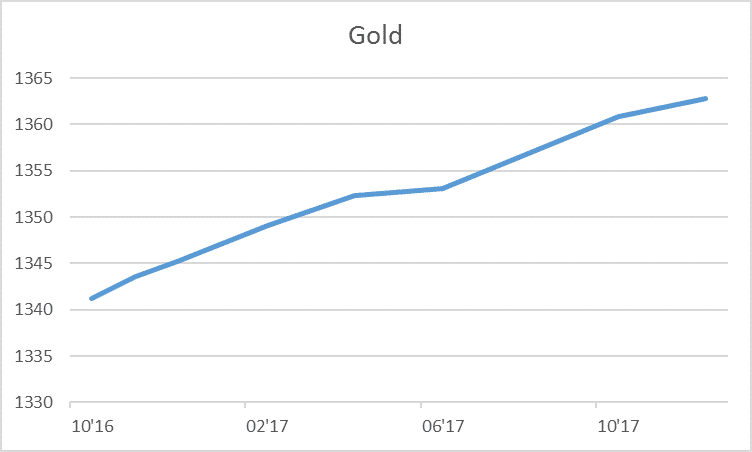

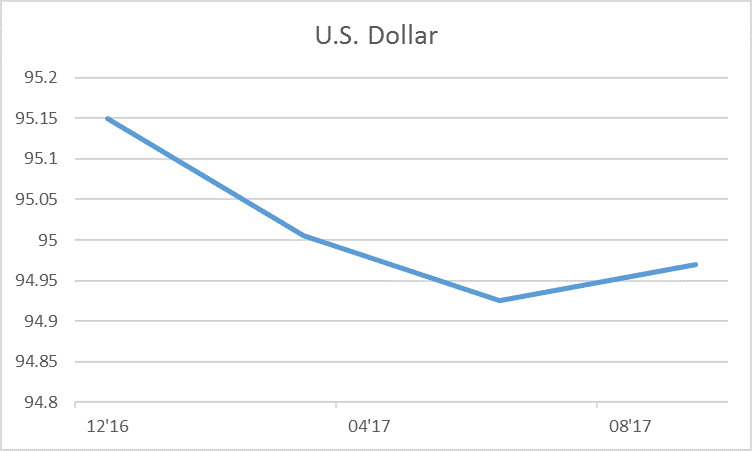

So where are various markets currently sitting in terms of backwardation and contango, here’s our recent check in:

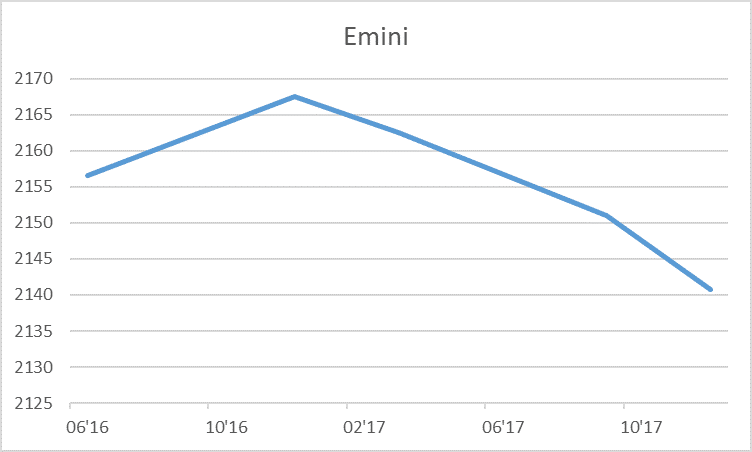

Markets in Contango:

Data as of (9/22/2016)

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

Mixed Markets:

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

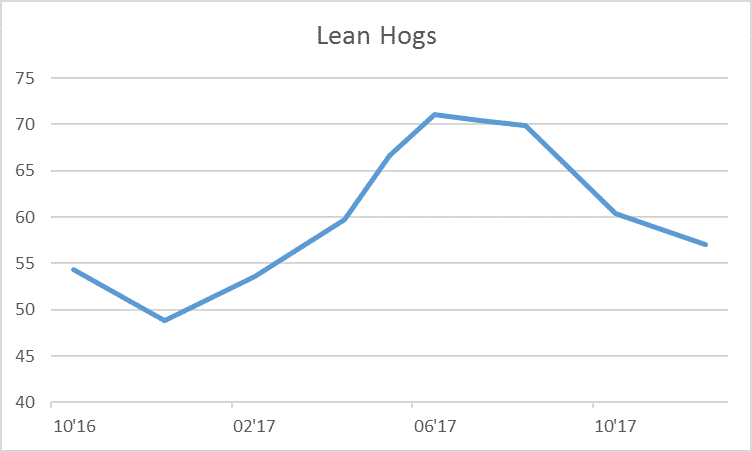

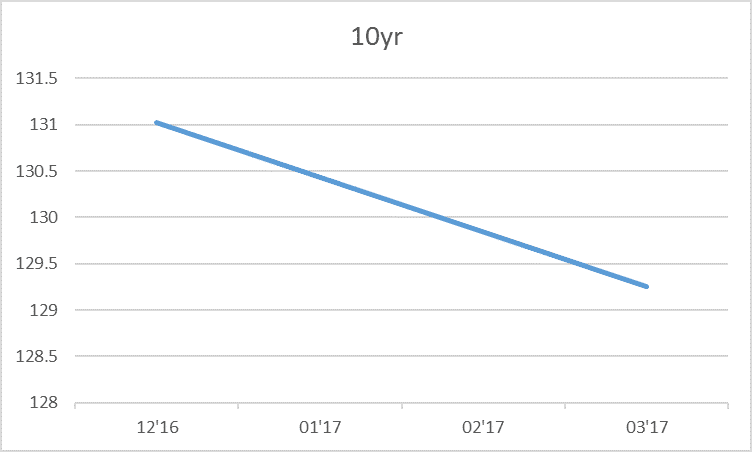

Markets in Backwardation:

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

Disclaimer

The performance data displayed herein is compiled from various sources, including BarclayHedge, and reports directly from the advisors. These performance figures should not be relied on independent of the individual advisor's disclosure document, which has important information regarding the method of calculation used, whether or not the performance includes proprietary results, and other important footnotes on the advisor's track record.

The programs listed here are a sub-set of the full list of programs able to be accessed by subscribing to the database and reflect programs we currently work with and/or are more familiar with.

Benchmark index performance is for the constituents of that index only, and does not represent the entire universe of possible investments within that asset class. And further, that there can be limitations and biases to indices such as survivorship, self reporting, and instant history. Individuals cannot invest in the index itself, and actual rates of return may be significantly different and more volatile than those of the index.

Managed futures accounts can subject to substantial charges for management and advisory fees. The numbers within this website include all such fees, but it may be necessary for those accounts that are subject to these charges to make substantial trading profits in the future to avoid depletion or exhaustion of their assets.

Investors interested in investing with a managed futures program (excepting those programs which are offered exclusively to qualified eligible persons as that term is defined by CFTC regulation 4.7) will be required to receive and sign off on a disclosure document in compliance with certain CFT rules The disclosure documents contains a complete description of the principal risk factors and each fee to be charged to your account by the CTA, as well as the composite performance of accounts under the CTA's management over at least the most recent five years. Investor interested in investing in any of the programs on this website are urged to carefully read these disclosure documents, including, but not limited to the performance information, before investing in any such programs.

Those investors who are qualified eligible persons as that term is defined by CFTC regulation 4.7 and interested in investing in a program exempt from having to provide a disclosure document and considered by the regulations to be sophisticated enough to understand the risks and be able to interpret the accuracy and completeness of any performance information on their own.

RCM receives a portion of the commodity brokerage commissions you pay in connection with your futures trading and/or a portion of the interest income (if any) earned on an account's assets. The listed manager may also pay RCM a portion of the fees they receive from accounts introduced to them by RCM.

Limitations on RCM Quintile + Star Rankings

The Quintile Rankings and RCM Star Rankings shown here are provided for informational purposes only. RCM does not guarantee the accuracy, timeliness or completeness of this information. The ranking methodology is proprietary and the results have not been audited or verified by an independent third party. Some CTAs may employ trading programs or strategies that are riskier than others. CTAs may manage customer accounts differently than their model results shown or make different trades in actual customer accounts versus their own accounts. Different CTAs are subject to different market conditions and risks that can significantly impact actual results. RCM and its affiliates receive compensation from some of the rated CTAs. Investors should perform their own due diligence before investing with any CTA. This ranking information should not be the sole basis for any investment decision.

See the full terms of use and risk disclaimer here.