December 8, 2016

rcm-alternatives

Like

If you were to ask for the growth of Managed Futures assets in 2015, you might get different answers depending on who you ask. Barclayhedge will tell you $8.5 Billion, we think that number is more about $10.5 Billion, and a third party recently made the claim of as high as $30 Billion at a recent conference. Being the Managed Futures nerds that we are, this certainly caught our interest.

We’ll take the speaker at his word and assume those numbers were based on some hedge fund inflows report or another – but it got us to thinking of how much of the total assets (not just inflows) are controlled by the largest firms. Back in 2013, we discovered the 35 largest CTAs controlled 65% of the AUM, and it turns out it’s only gotten worse.

To find the answer this time round, we took all of the managers in the Barclayhedge managed futures database that have reported returns in 2016, then removed distinctly non managed futures hedge funds ,aka Bridegwater, to arrive at a universe 263 managers controlling 733 programs. We then summed up the assets to see just how top heavy the space is.

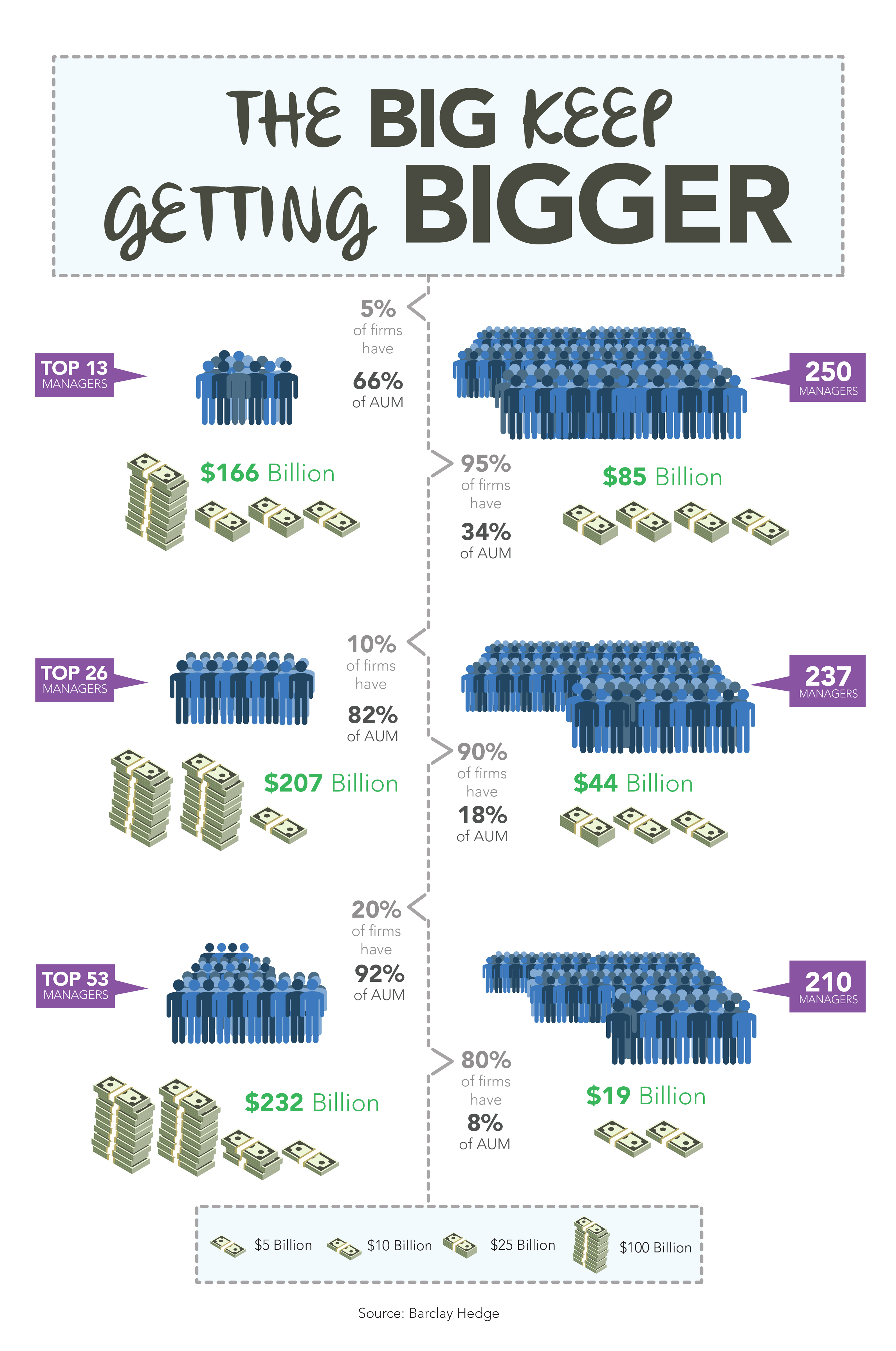

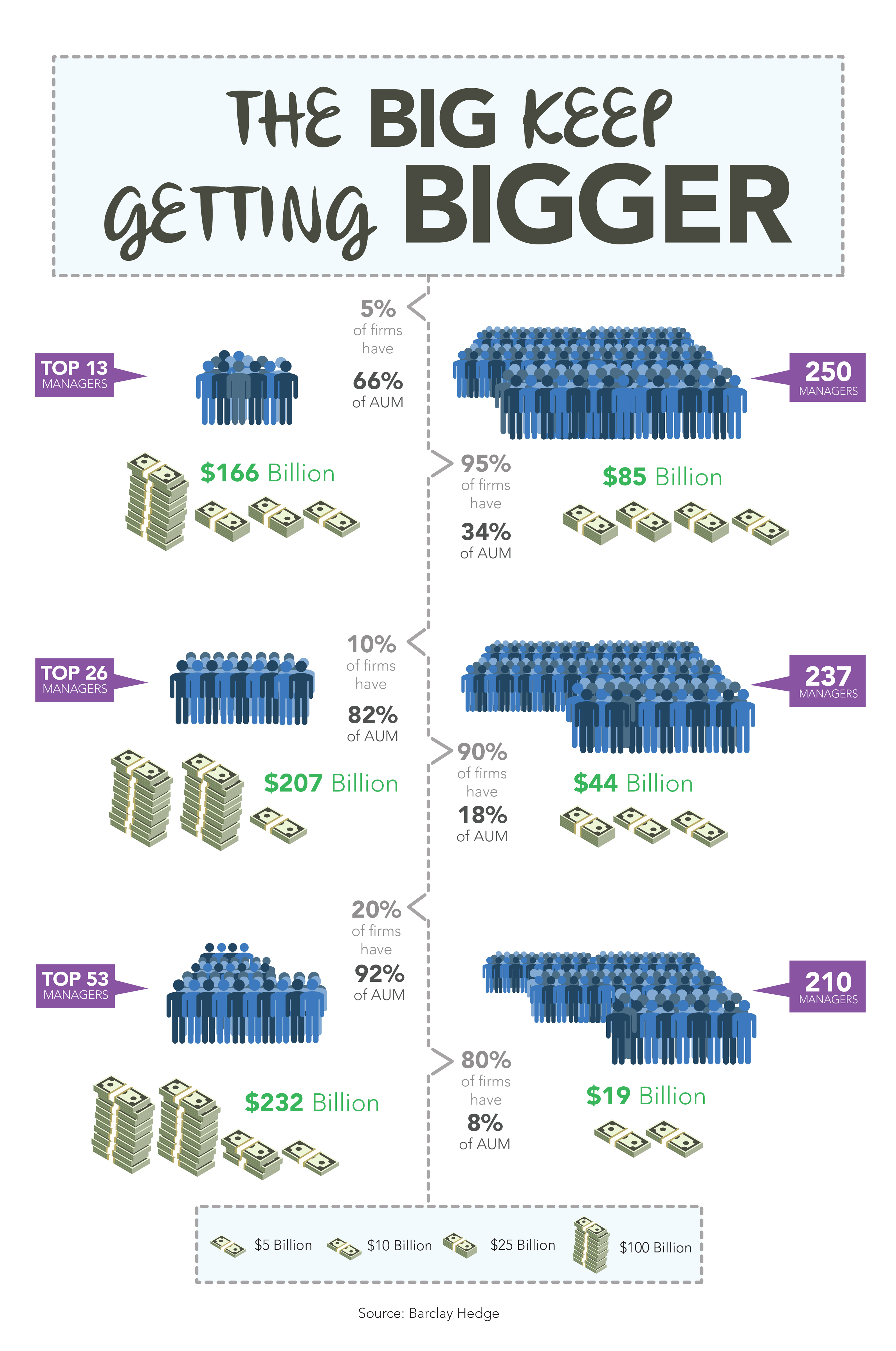

The answer is… it is very top heavy, with the top 5% of managers (just 13 firms) controlling 66% of the total assets, $166 Billion. By the time you get to the top 20% of managers, there’s only $19 Billion left in AUM for 210 managers. Here’s the breakdown:

This isn’t a new problem… but it does seem to be getting worse, with the largest managers checking the right boxes to get the largest allocations in a self-fulfilling circle, leading all the way to the bank. Investors, meanwhile, may be doing themselves a disservice in boxing themselves into a smaller and smaller universe of managers who can meet asset thresholds and stringent operational due diligence tests, forgetting perhaps – that bigger is not better in the managed futures space – with bigger leading to problems in terms of market impact, position limits, and tradeable markets (larger managers portfolios tend to be more heavily skewed towards financial instruments away from commodities).

At the same time, we’re hearing from more and more investors that they desire emerging managers and the often higher returns they can offer (even if it comes with a wider dispersion of returns – more on that in an upcoming whitepaper). But that’s not what’s happening according to the stats. According to the stats, that seems to be just lip service and a ‘wish’ of large investors instead of an actual allocation plan.

For now, we seem destined to watch the largest managers continue to get larger until…. something like – closures, performance flattening, underperformance due to financials exposure, etc – happens to shift investors wallets, not just their mindsets.

Disclaimer

The performance data displayed herein is compiled from various sources, including BarclayHedge, and reports directly from the advisors. These performance figures should not be relied on independent of the individual advisor's disclosure document, which has important information regarding the method of calculation used, whether or not the performance includes proprietary results, and other important footnotes on the advisor's track record.

The programs listed here are a sub-set of the full list of programs able to be accessed by subscribing to the database and reflect programs we currently work with and/or are more familiar with.

Benchmark index performance is for the constituents of that index only, and does not represent the entire universe of possible investments within that asset class. And further, that there can be limitations and biases to indices such as survivorship, self reporting, and instant history. Individuals cannot invest in the index itself, and actual rates of return may be significantly different and more volatile than those of the index.

Managed futures accounts can subject to substantial charges for management and advisory fees. The numbers within this website include all such fees, but it may be necessary for those accounts that are subject to these charges to make substantial trading profits in the future to avoid depletion or exhaustion of their assets.

Investors interested in investing with a managed futures program (excepting those programs which are offered exclusively to qualified eligible persons as that term is defined by CFTC regulation 4.7) will be required to receive and sign off on a disclosure document in compliance with certain CFT rules The disclosure documents contains a complete description of the principal risk factors and each fee to be charged to your account by the CTA, as well as the composite performance of accounts under the CTA's management over at least the most recent five years. Investor interested in investing in any of the programs on this website are urged to carefully read these disclosure documents, including, but not limited to the performance information, before investing in any such programs.

Those investors who are qualified eligible persons as that term is defined by CFTC regulation 4.7 and interested in investing in a program exempt from having to provide a disclosure document and considered by the regulations to be sophisticated enough to understand the risks and be able to interpret the accuracy and completeness of any performance information on their own.

RCM receives a portion of the commodity brokerage commissions you pay in connection with your futures trading and/or a portion of the interest income (if any) earned on an account's assets. The listed manager may also pay RCM a portion of the fees they receive from accounts introduced to them by RCM.

Limitations on RCM Quintile + Star Rankings

The Quintile Rankings and RCM Star Rankings shown here are provided for informational purposes only. RCM does not guarantee the accuracy, timeliness or completeness of this information. The ranking methodology is proprietary and the results have not been audited or verified by an independent third party. Some CTAs may employ trading programs or strategies that are riskier than others. CTAs may manage customer accounts differently than their model results shown or make different trades in actual customer accounts versus their own accounts. Different CTAs are subject to different market conditions and risks that can significantly impact actual results. RCM and its affiliates receive compensation from some of the rated CTAs. Investors should perform their own due diligence before investing with any CTA. This ranking information should not be the sole basis for any investment decision.

See the full terms of use and risk disclaimer here.