It’s that time of year. March madness, the end of winter, and tax season. There’s no argument taxes are the worst of those three, whether because of the money going out the door or the complexity of the tax code. A recent article mentions tax codes may change up to +500 times. But where there’s complexity, there can be opportunity.

Those of us who invest or trade futures markets have a little different take on tax season, feeling a little more celebratory. You see, futures markets don’t just give you exposure to world markets and the ability to go both long and short – there’s some real tax advantages as well. It all starts with exchange traded futures and options on futures being labeled as ‘Section 1256 Contracts’ by the IRS.

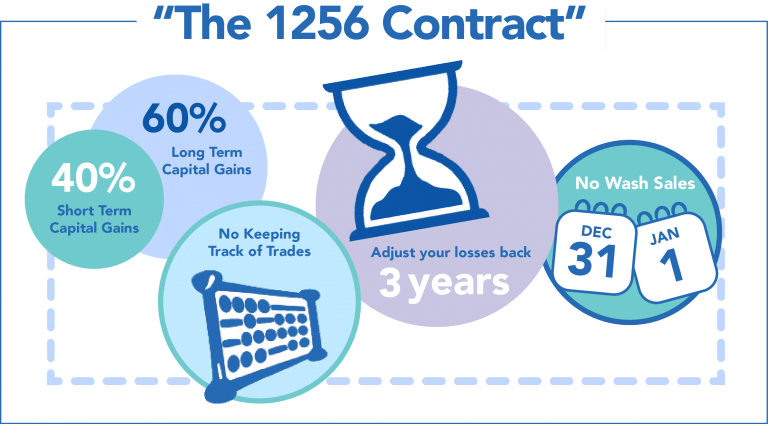

Unlike stocks, futures based investments are based on their marked to market value at the end of the year, so any open trade profits or losses in the account are treated as realized profits or losses as of the last day of the year. This is generally good news for investors, as futures gains or losses are treated as 60% long term capital gains and 40% short term capital gains, NO MATTER the holding period. For example, an investor who holds a futures position for just a few minutes, or hours, can book 60% of the profits on that trade as long term gains (and pay the lower long term capital gains rate) – even though the trade was anything but long term.

In addition, futures based investments do not require the accounting of individual trades. This is a godsend for any of you who have spent hours searching through old brokerage statements from 4 years prior trying to find the cost basis for a certain stock. There is also no trade by trade accounting in futures, no wash sale rules, and losses can be carried back three years on futures based investments. Not too shabby.

But what if you’re not really a futures ‘trader’? What if you’re more of a futures investor, accessing the futures markets through a professional manager utilizing either separately managed accounts, private funds, or (as is becoming more and more normal) mutual funds and ETFs.

Separately Managed Accounts:

An investor having their futures account managed for them by a professional commodity trading advisor (CTA) gets all of the same futures market based tax treatment outlined above, as the manager trades the same exchange traded futures. That’s the good news, but there’s a catch – the CTA’s management and incentive fees are not part of the section 1256 gains and losses, meaning the 1099-B reports the marked to market profit or loss before these fees. All hope is not lost, however, as investors can offset some of those fees by doing itemized deductions and taking investment-related deductions. Problem is, such miscellaneous itemized deductions are only deductible to the extent they exceed 2% of your adjusted gross income. So, an accredited investor making $300,000 per year can only deduct expenses over $6,000 (2% of $300k). Investors utilizing separately managed accounts receive a 1099-B from the Futures Commission Merchant holding the account, with the total amount of fees paid to the CTAs available via your broker or the CTA you’re invested in (there’s no required government report outlining the total fees).

Privately offered Funds

Which brings us to investors who access the futures markets through privately offered funds, or as their also known – commodity pools. Fund investors haven’t really ‘traded’ futures markets themselves or had futures traded in accounts in their name. They’ve invested in a partnership (for tax purposes) which does the futures trading, and the partnership reports what portion of the futures trading profit or loss is taxable to each investor every year. The good part of that is the tricky 2% of adjusted gross income barrier goes away, with the fund able to offset all the expenses to the fund (including management and incentive fees paid to the trading advisor) against profits. The (semi) bad part… the investor receives a K1, which in our experience never gets into your hands as quickly as you would like, potentially delaying your tax filing. Many people find a single K1 much easier come tax time, however, than multiple 1099-Bs outlining futures profit and loss. Finally, there is no taxable event upon redeeming your investment in a private fund, meaning you don’t pay capital gains on the difference between the sales price and purchase price (you’ve already paid tax via the K1 numbers each year).

Liquid Alternatives – Mutual Funds & ETFs

Which brings us to the fast growing world of alternative investment mutual funds and ETFs. The biggest difference in mutual fund taxation is that there is a profit or loss from the buying and selling of the mutual fund (not just from what’s happening inside of the fund like in the private fund/K1 scenario). Buying a mutual fund for $5,000 and selling it later on for $7,000 will result in $2,000 for taxable capital gains. Further, the blended 60/40 tax treatment of futures markets doesn’t survive the mutual fund wrapper, with investors getting a 1099 listing the annual capital gain and dividend income from the mutual fund and that being treated as normal capital gains income, going into either the long term or short term buckets, not both. But ignorance is bliss for many in this regard, as they willingly sacrifice whatever tax savings may be present from a K1 structure in order to receive a 1099 1 to 2 months earlier.

Happy Tax Season!

If you have any questions about different tax codes or exposures when it comes to futures trading, please feel free to give us a call at 855-726-0060; with the very large caveat/disclaimer that we are not tax attorneys.