This isn’t a chart you see too often…

It looks more like the latest meme coin than a proper investment. But this is actually happening this year, with Mulvaney Capital putting up +45% in February 2024, and +51% in March of 2024. Signup for the RCM Manager/Fund database to view the full historical performance track record for Mulvaney Capital Mgmt. Those aren’t annual returns… those are monthly returns! We talked about Trend Followers being Kuckoo for Cocoa Puffs – and indeed much of these gains are on the back of the huge move in Cocoa, whose chart looks suspiciously like the Mulvaney chart.

How is Mulvaney and the Global Markets Fund, Ltd doing it? Here’s a bit of summary from @scottPh77711570 on X/Twitter (apologies for some of his language)

Now, about it being one of the greatest trades of all time, that’s up for debate. Soros breaking the Bank of England? Paul Tudor Jones in ’87? Anyone in the Big Short?

Outlier Gains are a Part of Managed Futures

And while this is as impressive as we’ve seen in quite some time, it is by no means unprecedented in the managed futures and CTA space (see here for what that difference in those terms is). A few programs we know have done similar things. Here’s some of EMC’s early performance in their ‘Classic Program’ (see their disclaimer below):

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING COMMODITIES CAN BE SUBSTANTIAL. YOU SHOULD CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK, INCLUDING LIQUIDITY RISKS, NO SECONDARY MARKET EXISTS, RESTRICTIONS ON REDEMPTIONS AND THE RISK OF FOREIGN SECURITIES. Performance represents all accounts traded in the EMC Classic Program, net of all fees. EMC Classic does not reflect the performance of any one account, but rather a combination of the historical performance of multiple accounts and portfolios with varied fee structures. Therefore, an individual account and a particular trading portfolio may have realized more or less favorable results than the composite indicates. Prior to October 1, 2013, accounts were managed by EMC Capital Management, Inc. the predecessor of EMC Capital Advisors, LLC.

And here’s some crazy good Dunn Capital years (see their disclaimer below)

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THE POTENTIAL FOR PROFIT IS ACCOMPANIED BY THE RISK OF LOSS. This Program is available only to Qualified Eligible Participants as defined by CFTC Regulation 4.7.

As well as some great years from Jerry Parker at Chesapeake in his Diversified Program:

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THE POTENTIAL FOR PROFIT IS ACCOMPANIED BY THE RISK OF LOSS. This Program is available only to Qualified Eligible Participants as defined by CFTC Regulation 4.7.

Finally, John Henry literally made enough money behind over 8,000% in total returns across his programs to buy the Boston Red Sox with his early success in Trend Following (read more on that in our History of Managed Futures Whitepaper)

It’s not all Rainbows and Lollipops

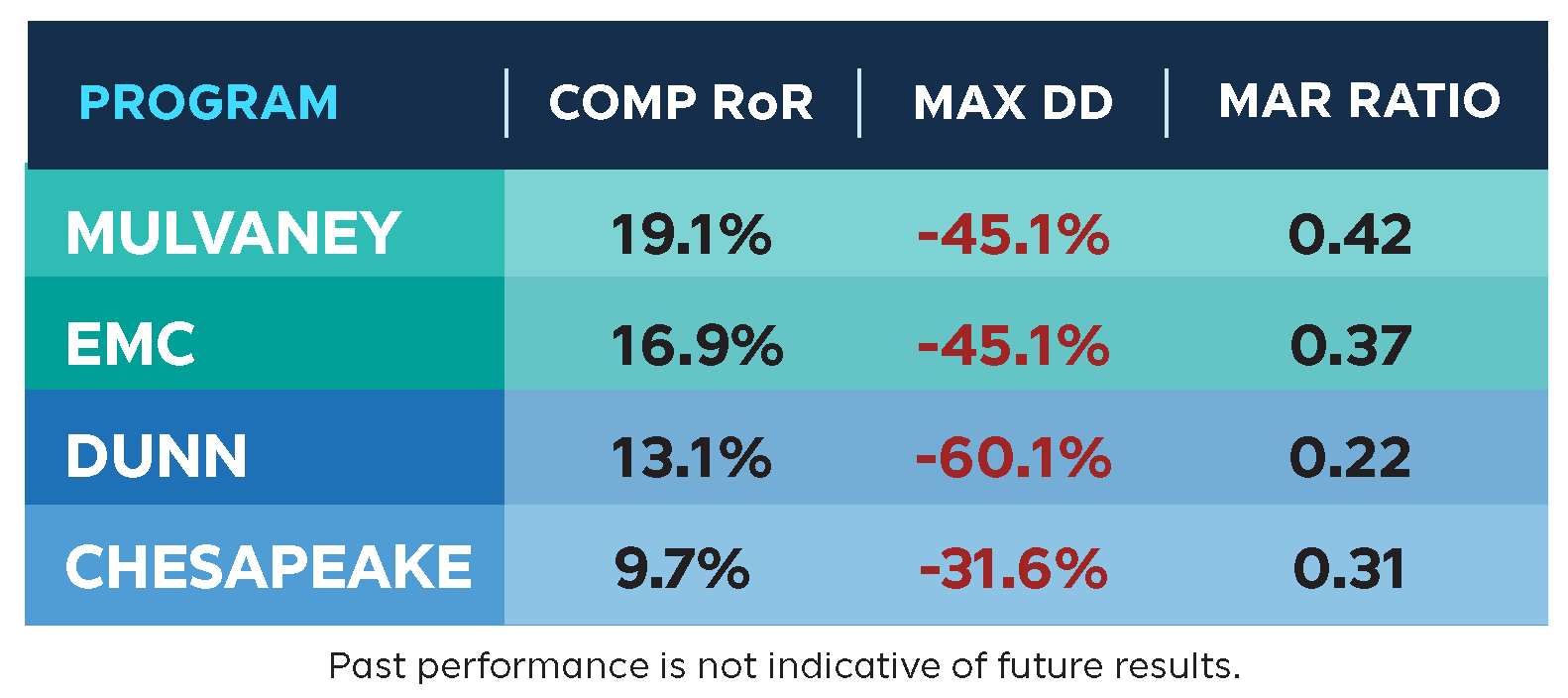

Of course, none of this comes without risk. The larger the volatility, the larger the potential drawdowns. Here’s the max Drawdowns of all the aforementioned programs.

The more amazing thing these days about Mulvaney’s performance is that there is a program out there with a 30 vol swinging for the fences in such a way, not that he is clearing the fence every now and then. Most CTAs these days have deliberately reduced their volatility in an effort to attract more institutional money, like all of the other managers mentioned above have done. For now, we’ll tip our cap, keep cheering Cocoa higher, and hoping Mulvaney doesn’t take down the rest of the trend followers long Cocoa when his models decide to exit.