Our apologies for the cheesy headline, but we have this wonderful word in the futures industry – Contango – and we just so happened to come across a nice piece on McClellan Financial covering Crude Oil’s move away from Contango into Backwardation, giving us a chance to talk Contango…

First, what is Contango:

When the near month contract is priced lower than the out months, that condition is known as “contango”. In commodities like gold and silver, contango is the norm since the available supply consists of not just the mining production but also all of the bullion sitting in warehouses and safes around the world.

But because oil is so much more expensive to store than gold is, there is not the same sort of standing inventory available to remediate temporary supply-demand disruptions. So oil prices can move to very large conditions of contango, or to the opposite condition known as “backwardation” like we are seeing right now.

The normal market-based remedy for a large contango condition is for speculators to buy the cheaper commodity in the spot market and put it into storage, then sell a distant month futures contract to take advantage of the price difference between near month and out month pricing. That can be a profitable game if the amount of that price spread is sufficient to pay for both the storage costs and the cost of capital. So there is a natural limit to how big a contango can get, assuming that there are storage facilities available.

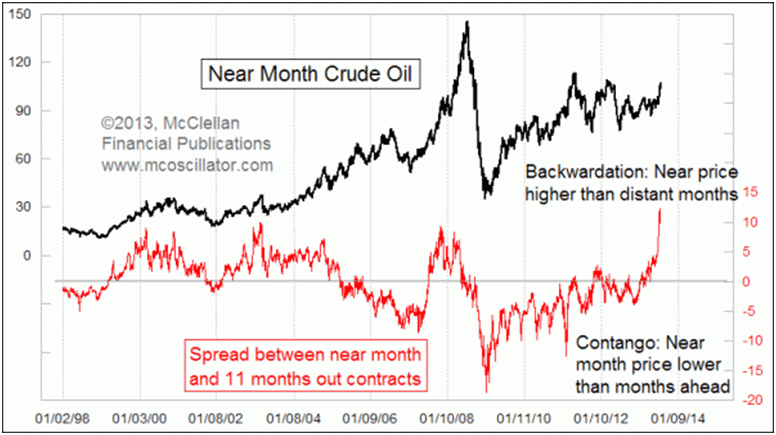

But the thing which is catching McLellan’s eye isn’t Contango in Crude, it is the highest level of Backwardation (reverse Contango, if you will) in more than 15 years, reversing the major Contango conditions which persisted for most of the post financial crisis period (2009 to 2011):

“The near month futures contract for light sweet crude oil right now is the August 2013 contract, which settled on July 18 at $108.22 per barrel. But looking out 11 months into the future to the July 2014 contract, we find that it closed at just $95.56. That is a huge difference, and it says that oil futures traders are not willing to bet on the current month’s high price continuing into the future. In other words, it is a temporary anomaly.”

“This current spread between the August 2013 and July 2014 contracts is the biggest raw price spread in years, although as a percentage of the current price we have seen more severe backwardation at other times.”

Chart Courtesy: McClellan Financial Publications

(Disclaimer: past performance is not necessarily indicative to future results.)

This spike higher in the spread between front and back month contracts in Crude Oil is causing difficulties for many of the spread trading CTAs we follow, but those traders are also saying this is a dramatic spike in the front months which can’t last for much longer. McClellan’s piece agrees on this front, saying [emphasis ours]:

The way that a backwardation condition gets resolved is either for consumers to use less of the high priced commodity now, or for producers to accelerated production to meet the higher current spot price rather than saving that production for later when prices are not as attractive There are limits on how quickly such production increases can be implemented, but a $12/barrel difference between the current price and that of 11 months out can pay for a lot of improvements to production capacity. There are also limitations on how much demand can be reduced due to higher prices. People still have to drive to work, and they still want to take the Winnebago to Yellowstone.

This current spread between the August 2013 and July 2014 contracts is the biggest raw price spread in years, although as a percentage of the current price we have seen more severe backwardation at other times. The message to take from this is that the current pop in near month futures prices is not likely to continue much farther, with the rubber band already stretched.”

One item not included in the piece is the structural anomalies surrounding Cushing, Oklahoma and all of the problems getting the shale oil production out of the middle of the US. The following chart shows that we’re well on our way to fixing that problem, with the amount of oil being sent down to the Gulf Coast from Cushing set to triple by this time next year. That is likely keeping a lid on further out Oil contracts as well.

Chart Courtesy: Reuters

(Disclaimer: Past performance is not necessarily indicative to future results.)

What’s it all mean for managed futures? Well, one well known Crude oil spread trader sure wants to see that Backwardation spike reverse course to the benefit of his short Oil spreads. After that, your run of the mill CTA doing trend following might be overpaying in the front month contract if he’s looking for a several month’s long trend upwards. This costs them some profitability if Crude continues to rise, and causes larger than expected losses should the up trend stall out and the backwardation spike revert to the mean some.

We’ll let the energy specialists figure all this out for now.

July 23, 2013

Great Article Attain. You are right on.

July 23, 2013

The front month premium is good for Trend Followers who are long because when they go to roll the contract they Sell for a higher price than what they buy the next contract for thereby locking in the Backwardation as profit.

In the GFC the Contango was a big reason for the huge downtrend. Other markets like the Vix Futures make a large portion of profits on the downside due to amount of Contango (caused by the Volatility Risk Premium in Vix).

July 23, 2013

Interesting take that is for sure! I would however point out that IF the backwardation in Crude Oil continues, then it actually may benefit the trend following traders who choose to concentrate positions in the first or second month crude oil contract.

This is because every time Long trend followers roll into a new contract, which is a hefty 12 times a year for crude oil, they are now buying the new oil contract at a cheaper price than where they exited the previous contract. The implication here is that IF the spot price stays the same for the entire year then they will get paid as the new contract rises to revert to the mean of the spot price. Make sense? The implications of a backwardated market are that the long term trend follower can now make money in both bull and neutral markets, as long as the backwardation continues. And if the markets continue to trend higher…then they are getting paid on the trend AND the roll yield. This is why crude oil bull markets that are in backwardation can be such important driver of returns for CTAs that pursue the strategy.

But of course, there is no Guarantee that any of the past performance of crude oil Trend Followers buying crude oil in a bull market, amidst backwardation conditions, will make money in the future. Or that they, or any other trader, will make money in the future. Please carefully refer to all Disclaimers below before considering these ideas further…there is a substantial risk that they MAY or COULD be dangerous.

July 24, 2013

Looks like we are on the same page! The moderator had not approved your post yet when I posted my comment…otherwise I would’ve just agreed with ya!

But even after today, the backwardation hasn’t changed much. And of course, along the same lines that we both mentioned, longs that rolled from the August to the September contract at a discount accrued smaller losses on this spot decline…while shorts who did the opposite didn’t gain near as much as they could have. Its certainly a very interesting feature of the Spot price/backwardation/contango relationship!

I’ve modeled crude oil spreads using a variety of statistical analysis methods and of all the futures spread I’ve analyzed, they present some of the most interesting challenges. But anyone trading energy futures must make their peace with how to approach the spread problem…even if its just a historical comparison between the front month and the contract 11 months out…otherwise unintended risks will accrue! Analyzing other parts of the crude oil forward curve seems to be more popular in my experience (although several competing theories differ on this matter and there is no Guarantee any of them will “work”).

Have we mentioned the disclaimers at the bottom of the page yet? No? See Disclaimers. Below. 🙂

July 25, 2013

As a reminder, backwardated markets do not always generate positive roll returns. Roll yield is the return that results from changes in the basis due to the passage of time and/or changes in the cost of carry. Assuming spot prices and the term structure of forward prices are constant, a positive (negative) roll yield is earned in a backwardated market (contango) market. In the short-run, the term structure can shift such that roll returns in a backwardated market are negative.

To define roll return, it occurs over the contract holding period and is the difference between the futures price when the contract is opened and the futures price when the contract is closed less the change in the spot price over the holding period.

Roll yield is earned in backwardated and contango markets since it is driven by changes in the basis rather than the shape of the term structure.

February 4, 2014

[…] Then there’s this not-so-insignificant situation in futures markets in which futures prices are above the expected future spot prices. “This is the situation today. It’s been this way for five years,” Chiappinelli said. “The industry has a term for it, it’s called contango. We have a term for it at GMO. It’s called: you lose.” (For more on contango, see “It Takes Two to Contango . . .“) […]

February 8, 2016

[…] (just like in our example above – where the further out was $7 higher than the nearby). We in the futures business call it Contango. […]