You got to hand it to the marketing folks over at Wisdom Tree…. No sooner had the ink dried on Managed Futures good 3rd quarter and the Dow hit new 8 month lows this week than we started to see Wisdom Tree advertising their Managed Futures ETF ($WDTI) on CNBC. Marketing 101 = strike while the iron’s hot.

But how much “managed futures” exposure are you really getting with this product. We’ve looked under the hood of WDTI before, back when it launched in 2011, and thought it was high time to meet their managed futures marketing blitzkrieg during this stock market correction with some data and information on how well this product does what it purports to do (track managed futures).

- WDTI is a replication strategy

WDTI doesn’t track a managed futures index made up for actual managed futures managers providing alpha for their clients and managing real money. WDTI tracks something called the Diversified Trend Indicator (DTI), created by Victor Sperandeo, aka “Trader Vic”. The DTI tracks 24 markets (50% financials, 50% commodities) on a monthly basis and is designed to reflect rising and falling price trends in those markets. That is somewhat similar to the models used by systematic multi-market managed futures programs, but not completely similar. It is an attempt to capture the bulk of what they do at a lower price point, without the sophistication around the edges.

- WDTI hasn’t replicated Managed Futures very well

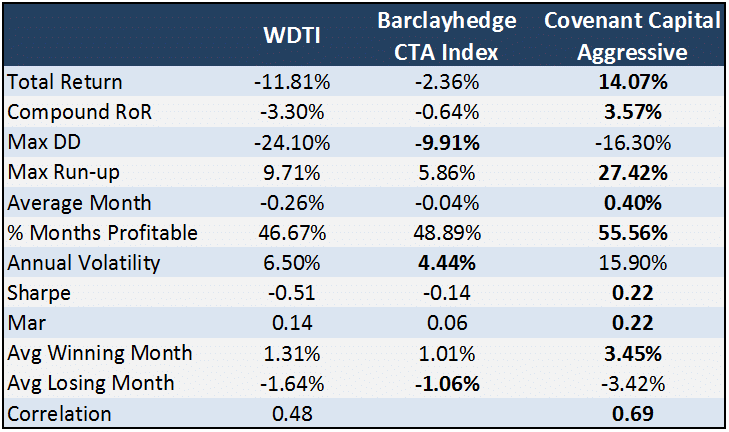

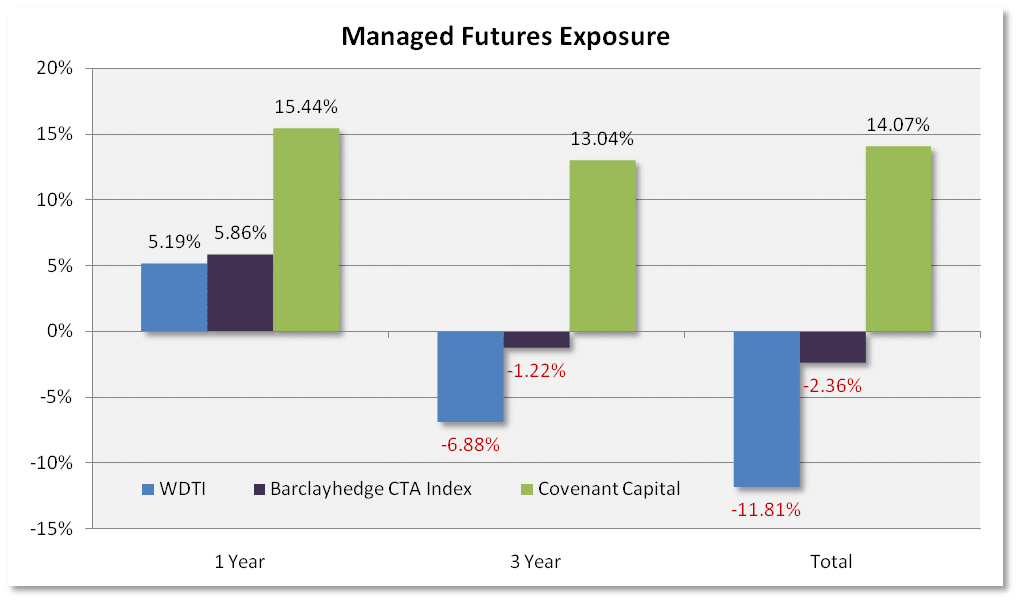

So how has the WDTI done in replicating managed futures exposure… not great. Since its launch, it’s trailed the managed futures index (which we would think should be its benchmark) by 1,117 basis points (11.17%). And what about a real program, not just the index. It’s trailed Covenant Capital’s Aggressive program, the same model used by our Trend Following Fund by 2,588 basis points (25.88%) since it was launched. And that’s after Covenant’s 2 & 20 fees. Past Performance is not necessarily indicative of future results.

(Disclaimer: past performance is not necessarily indicative of future results)

Data points: 1/11 – 9/14

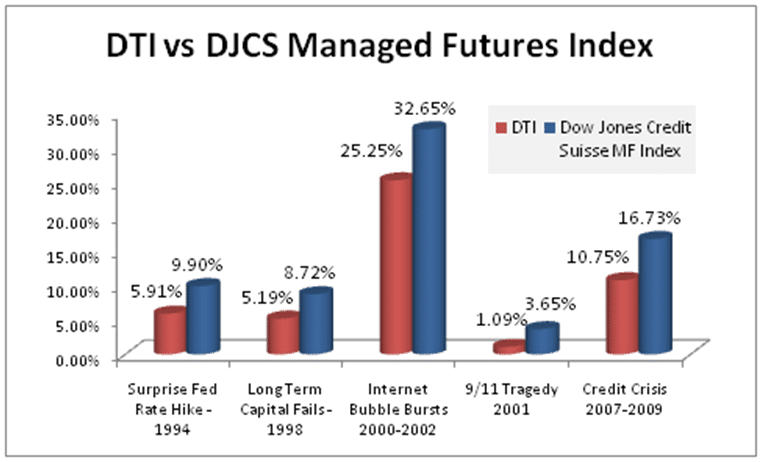

- DTI underperforms Managed Futures in market crisis periods

While the ETF itself only goes back to 2007, the DTI goes back quite a bit further, allowing us to be able to see just how the indicator has done in past crisis periods. You can see it has underperformed the managed futures index in past crisis periods.

(Disclaimer: past performance is not necessarily indicative of future results)

(Disclaimer: past performance is not necessarily indicative of future results)

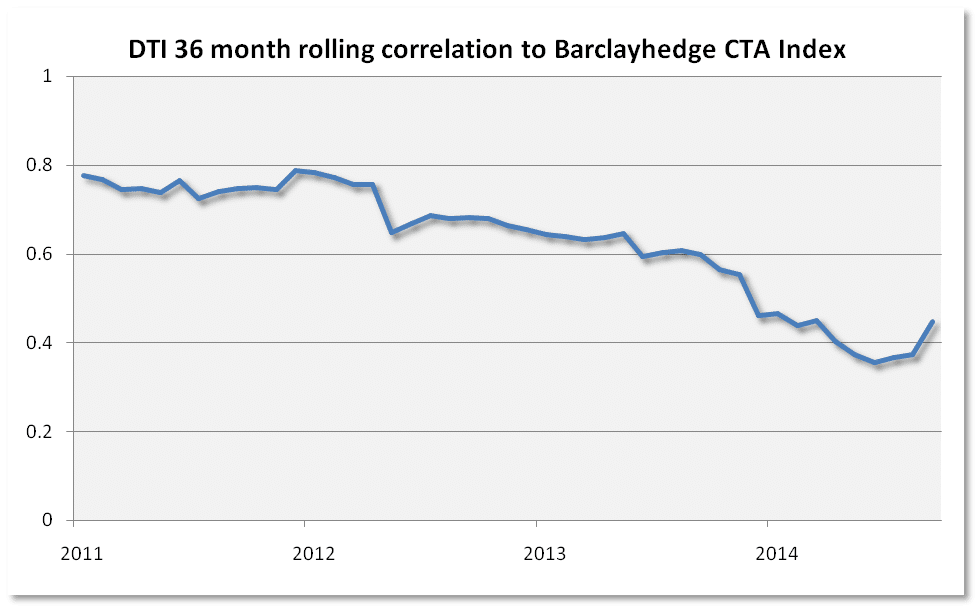

- DTI is becoming less and less correlated with Managed Futures

Notice the interesting pattern below, where the DTI has become less and less correlated with the managed futures index over the years. Why? Because one of them (managed futures) is the results of actual managers continuously doing research and improving their models. And one is a single indicator designed years ago.

(Disclaimer: past performance is not necessarily indicative of future results)

(Disclaimer: past performance is not necessarily indicative of future results)

- 25% of the portfolio is in just 2 markets

With 13% of the portfolio tracking Euro currency futures and 12% tracking Japanese Yen futures, a full quarter of the portfolio is in just two markets. Watch out if those two are in an extended sideways period without trends.

- WDTI doesn’t go short energy…

We just don’t get this one. Why the arbitrary rule just for one sector of the portfolio. They say it is to protect against the risk of ruin, as energy markets can spike on geo political events. But at the same time they allow short trades in Natural Gas &*^%. And have you seen the volatility in Cocoa, or Copper, or Coffee – talk about price spikes.

- There are no intra-month position adjustments

We don’t quite get this one either. What if a trend starts, or ends, during the middle of a month? Guess you get in or out late. This surely cuts down on Transactional costs and keeps things simple, but we’re sure it cuts down on performance also.

- WDTI is Average, by design

At the end of the day, Wisdom Tree looks to have decided to try and replicate the beta of managed futures via an imperfect proxy, the DTI. What will that look like moving forward? The “average” performance of the managed futures index? Something less? Something more? ‘Average’ looks less and less likely as the indicator continues to diverge from the live managers doing trend following strategies, with ‘less’ possible if there are no trends in the euro and yen while a short trend in energy, and a ‘more’ scenario dependent on trends in that concentrated currency exposure and hopes of an uptrend in energy.

October 17, 2014

[…] Smart asset allocators prepare, not react. (Pragmatic Capitalism) […]