With much anticipation, the Mini DAX future contract is in its first day of trading on EUREX today with its own ticker symbol ($FDXM) compared to the full DAX contract at ($FDAX), and there’s been quite a stir over what the future holds for the contract in the futures industry. We’re heard some rumblings from some that think it’s going to follow in the emini S&P futures contract footsteps that launched back in 1997 (wow, was it was that long ago?!), while others see it as just another contract.

Our contact at the iSystems platform, which trades predominantly Dax, had this to say about the launch:

We have been observing it today, and it has done very little volume, just 1666 contracts and super-wide spreads (3-4 points average vs. 0.75 average on the big contract). We hope it improves, but think traders need to observe it for at least one month, in order to be able to estimate the slippage.

Just how big can the mini-Dax get? Well, Eurex shareholders no doubt have their eye on the e-mini S&P, which is trading at about 1.8 million contracts per day. Or, in their own back yard, maybe their eyeing the Euro-Stoxx contract which clocks in about 961,000 contracts per day. There’s no denying the opportunity here, with over 126,000 open interest contracts on the full DAX Dec 2015 futures contract right now, and the DAX ($FDAX) representing the stock index of the largest economy in the European Union.

But first, just what is a ‘mini’ contract?

The first ‘emini’ contract is now the largest and most popular one (coincidence?), the e-mini S&P 500 contract at the CME, which was the first electronic product at the CME through its Globex platform, which matched trades electronically versus the old fashioned way of Chicago men yelling at each other and throwing a bunch of paper on the floor.

The appeal of the emini at the time was that it was a much more affordable contract – with the full size S&P 500 futures contract worth 500 times the index, and the emini worth just 50 times the index (or 1/10th of the size). The emini later became just 1/5 the value of the full size when the S&P contract was changed to 250 times the index, paving the way for 1/5 the value to become the mini standard (same in the Russel, Nasdaq, and now Dax).

Traders big and small eventually flocked to eminis for numerous reasons, including better granularity for their speculation and hedging, faster fills (it was electronic so no need to wait on a call back), and the ability to trade it via the screen. There are now dozens of ‘mini’ contracts at the various exchanges, although the emini S&P remains the largest by far.

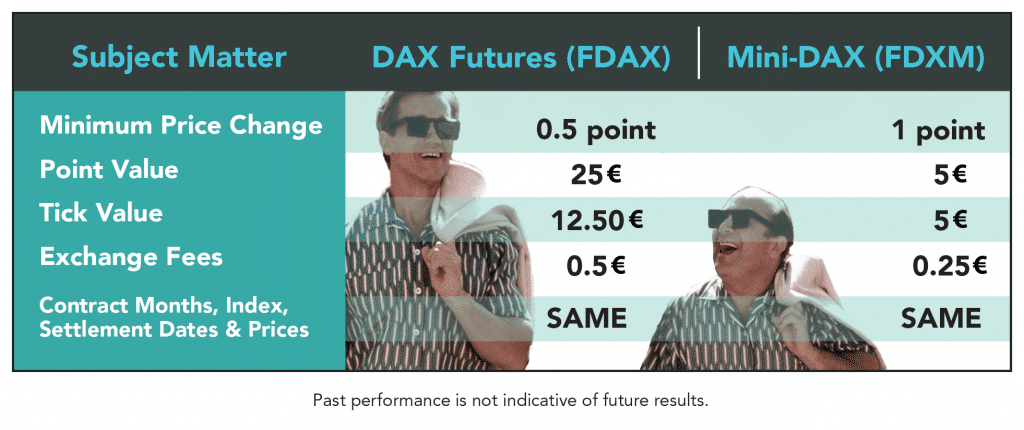

The Eurex version of the mini will essentially be a smaller “Twin” of the full size contract (just like here in the US, and Arnold and Devito in the Twins movie of course).

So just what did it take to get something like this going and what is Eurex’s expectations for the contract? Do they see it as the future of the DAX? We went to the source itself and got some answers from Ralf Huesmann in Eurex Product Development about what the Mini DAX could mean to the future of the industry, if anything.

RCM: Can you describe the process for Eurex to decide to launch the new mini Dax contract? Has Eurex received demand from CTAs or others in the space for a mini Dax contract or did Eurex see that the market needed it? Both?

Huesmann: Eurex had attempts in the past to launch a Mini DAX, but we have only now [seen] a majority of the market being in favour of such a launch. We had a very wide market consultation process with ~190 people from the industry participating across all regions and all kind(s) of client type(s). [The demand is] primarily driven by the high index level and the high notional [of the full size Dax], which makes hedging difficult and does not allow retail [traders] to participate.

RCM: What are the expectations for the mini-Dax contract?

Huesmann: In other markets, the Mini’s have either failed or taken over larger parts of the market over time… [with minis being] almost the whole market [in the US], but over a very long time. FDAX is extremely heavy, therefore we see good chances of success, but are not speculating on any numbers.

RCM: Do you think the mini Dax will cannibalize the liquidity of the full Dax contract?

Huesmann: It can´t be excluded that to some degree liquidity will shift from the full DAX to the smaller DAX, but our intention is more to offer new opportunities to those who had difficulties with the size of the big DAX in the past.

RCM: What’s the target market for the contract? CTAs / retail / institutional investor / all of the above?

Huesmann: Additional volume is expected from semi-professional traders (retailers), who have traded other (OTC) instruments in the past, but also from some arbitrage trading activities, as well as hedging for structured products. Depending how liquidity develops over time, the new contract will become attractive to more market participants also like HFT firms and CTA’s. Initial feedback from the CTA community has been extremely positive.

RCM: How much work behind the scenes (technology, etc.. ) is needed to get a new contact like this up and running?

Huesmann: Technology-wise, it is not complicated at all. That said, it was rather hard to find a consensus from the whole market on the different alternatives (i.e, simply changing the multiplier on the existing DAX vs. listing a parallel Mini contract vs doing nothing, what’s the right tick size, etc.).

RCM: Any additional comments Eurex wants to make about the new contract?

Huesmann: Market Makers signed up for the start and 2 or 3 will quote the contract even after European markets are closed. Therefore, the contract can become especially interesting for US clients. We got the proper CFTC approval to offer Mini-DAX directly in the US a few days ahead of launch.

So, any new contract launch will take a little time to grow, if at all – there’s plenty of contracts which never made it out there… but it does offer interesting opportunities for traders and professional managers alike. The daily volatility of the full size contract was something to behold – ranking among the most pricey contracts on a dollar range basis. For example, a 1% move in Dax futures represents about $3,000 worth of movement per contract, compared with a 1% move in Crude Oil being worth about $450 and 1% move in Corn being worth about $200 per contract.

Say you run a managed futures program that risks 0.50% per trade and you use a 1% market move as your risk proxy; you would need $600,000 in equity in the account to put on a full size Dax trade ($3,000 risk / 0.50%). Now, imagine the mini is available to you – where you only need 1/5 of that, or $120,000 – and it becomes if not an attractive addition to a portfolio, an affordable one.

One note on the cost of the new contract. It isn’t 1/5 of the cost of the full size contract (neither are any other eminis – these exchanges are about making money, after all), so the relative cost (cost per amount of exposure) is higher on the mini product.

We’ll have to wait and see if the Mini DAX wins over retail / institutional / CTAs over the full contract, or if it’s another drop in the bucket of contracts. Good Luck, Mini DAX.

October 30, 2015

I’ve been monitoring the Mini Dax too. It is getting more liquid, but I;ll only touch it when it becomes more liquid than the big DAX. Any idea how long it can take to grow in size> Did the ES take long to become liquid? Thanks,

Peter